In a world increasingly reliant on digital transactions, the security of sensitive financial data has never been more paramount. Banks are custodians of vast amounts of personal and financial information, making them prime targets for cybercriminals. As a result, the choice of encryption algorithm used to safeguard such data is not merely a technical decision but a cornerstone of public trust. Among the myriad of cryptographic algorithms available, Advanced Encryption Standard (AES) situates itself as the preferred choice for financial institutions. This article delves into the reasons why banks opt for AES over other encryption methodologies, exploring its intricacies and underpinnings.

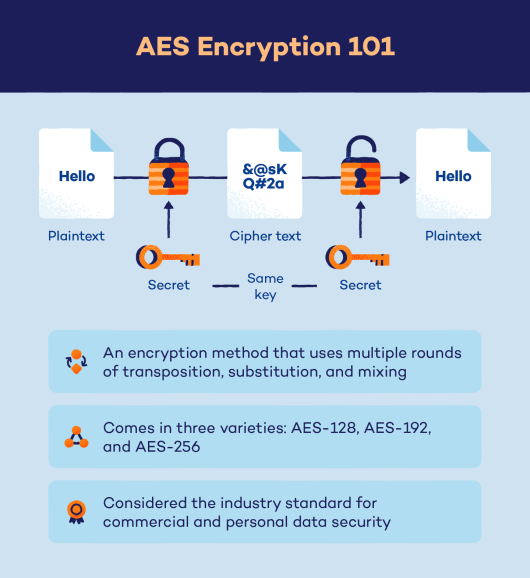

At the core of AES’s preeminence is its robustness. Established by the U.S. National Institute of Standards and Technology (NIST) in 2001, AES has undergone rigorous scrutiny and extensive testing. It is based on the Rijndael cipher, which operates on fixed block sizes of 128 bits and supports key sizes of 128, 192, and 256 bits. This architectural design not only promotes enhanced security but also allows for flexible key management, a crucial aspect when dealing with diverse transactional environments.

One must consider the proven resilience of AES against contemporary attacks. Compared to alternative algorithms such as DES (Data Encryption Standard) and 3DES (Triple DES), AES exhibits superior resistance to brute force attacks. DES’s relatively short key length of 56 bits rendered it vulnerable as computational power escalated; it can now be cracked within hours. In stark contrast, even AES with its shortest key length of 128 bits presents an astronomically larger key space. This exponential increase in complexity results in a security profile that reassures financial institutions, as the stakes remain extraordinarily high.

AES is meticulously designed to withstand a variety of cryptographic assaults. Techniques such as linear and differential cryptanalysis, which have historically compromised weaker ciphers, find little success against AES. The algorithm’s layered structure and substitution-permutation network contribute to its defensive architecture, creating complexity that thwarts attempts at data extraction. For banks, every additional layer of security represents a formidable barrier against potential breaches.

Interoperability is another critical advantage of AES. As banks operate within a diverse ecosystem of technological infrastructures, having a universally acknowledged standard is vital. AES is implemented across a broad spectrum of platforms and has been integrated into various protocols such as SSL/TLS, which facilitate secure communications over the internet. This cross-compatibility not only simplifies technical implementation but also standardizes security protocols across the globe, particularly vital for multinational banking operations.

Thus, performance and efficiency start to play their part. When it comes to executing cryptographic operations, AES strikes an impressive balance between security and speed. Its relatively streamlined structure allows for rapid encryption and decryption, enabling banks to maintain fast transaction throughput. This efficiency is further enhanced through hardware acceleration via the Advanced Encryption Standard Instruction Set (AES-NI), which significantly speeds up processing times, allowing for real-time encryption without taxing system resources. Banks can rest easy knowing they do not have to sacrifice customer service for security.

Another distinct benefit lies in the compliance landscape that banks must navigate. Regulatory bodies worldwide impose stringent standards for data protection, especially in sectors that handle sensitive information such as finance. AES is frequently cited as a benchmark for compliance with regulations like the General Data Protection Regulation (GDPR) in Europe and the Payment Card Industry Data Security Standard (PCI DSS). Utilizing AES enables financial institutions to adhere to these regulations, thereby maintaining not only their operational integrity but also their reputational standing in the industry.

The question of accessibility brings forth an interesting dimension. AES’s widespread acceptance translates into a prolonged lifecycle for the algorithm itself, with ongoing community support and emphasis on research and improvement. Banks harness this wealth of resources, knowing that any vulnerabilities that may surface are likely to be addressed swiftly by an active community of cryptographers and cybersecurity experts. This fosters an environment where security can evolve alongside emerging threats.

Moreover, the prospect of quantum computing looms large on the horizon, threatening the structures of traditional cryptographic methods. While many older algorithms may falter in this brave new world, AES’s architecture is more resilient, making it a formidable candidate for adaptation against such advancements. Banks, as guardians of trust, must remain vigilant, and AES positions them well for a future filled with uncertainty.

Finally, let’s not overlook the psychological aspect of choosing AES. Trust is an intangible yet potent currency in the banking sector. The strength of AES not only ensures data safety but serves to instill confidence in customers. Individuals are more likely to engage with a bank that openly employs robust and recognized security protocols. By adopting AES, banks ratify their commitment to protecting customer data, fostering a bond of trust crucial for long-term relationships.

In conclusion, the preference for AES in banking security is multifaceted, merging technological superiority with regulatory adherence and psychological assurance. Its proven robustness against attacks, efficiency in encryption, and ease of integration into existing systems create a compelling case for its adoption. As the landscape of cybersecurity continues to evolve, the unwavering reliance on AES stands as a testament to the importance of securing both assets and trust in an increasingly digital world.

Leave a Comment