In the digital age, the security of personal and financial data is of paramount importance. As cyber threats continue to evolve, so does the necessity for robust encryption technologies. Among these, 128-bit encryption has emerged as a standard that is widely trusted, especially within the banking sector. But what exactly is 128-bit encryption, and why do banks rely on it? This article uncovers the intricacies of 128-bit encryption, its significance, the mechanisms behind it, and its implications for consumer protection.

Understanding 128-Bit Encryption

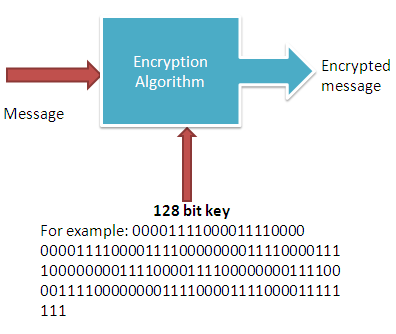

At its core, 128-bit encryption refers to the key length used in the cryptographic algorithms that secure data. A ‘bit’ is the most fundamental unit of data in computing, represented as either a 0 or a 1. Thus, a 128-bit encryption standard utilizes a key composed of 128 bits, which creates a staggering number of possible combinations—approximately 340 undecillion (3.4 × 1038) unique keys. This astronomical figure signifies that brute-force attacks, where an attacker tries every possible key combination, would take an unfeasible amount of time and computational power, rendering them impractical.

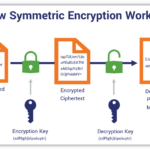

The Mechanics of Encryption Algorithms

Numerous encryption algorithms employ the 128-bit standard. One of the most notable is the Advanced Encryption Standard (AES), which was established by the National Institute of Standards and Technology (NIST) in 2001. AES operates under the principle of substitutive and transpositional encryption methodologies, where data is replaced and shuffled in a manner that renders it indecipherable without the proper key.

AES uses several rounds of transformation to enhance security. For 128-bit keys, the data undergoes 10 rounds of processing, encompassing substitution (where bits are transformed), permutation (the rearrangement of bits), mixing (combining data blocks), and key addition (integrating the encryption key). Each of these steps contributes to the overall complexity and integrity of the encrypted data.

Why Banks Embrace 128-Bit Encryption

Financial institutions handle an enormous volume of sensitive data, making it critical for them to implement stringent security measures. Banks trust 128-bit encryption for several compelling reasons:

- Robust Security: The immense number of potential key combinations ensures that unauthorized access remains virtually impossible. This provides peace of mind for both institutions and their customers.

- Regulatory Compliance: Financial entities are required to adhere to stringent regulations regarding data protection. Standards like the Payment Card Industry Data Security Standard (PCI DSS) necessitate advanced encryption technologies to safeguard consumer information.

- Industry Adoption: Widespread acceptance of 128-bit encryption by banking systems creates a network effect, where other institutions are incentivized to adopt similar technologies to remain competitive and secure.

Implications for Consumers

For consumers engaged in online banking or electronic transactions, understanding the backbone of encryption is critical. 128-bit encryption not only secures data during transmission—such as personal information, login credentials, and transaction details—but also builds consumer trust. Knowing that their information is safeguarded by a trusted security standard can foster a sense of reliability in financial institutions.

Furthermore, with the rise of mobile banking and digital wallets, the necessity for robust encryption has never been greater. The proliferation of mobile devices presents unique vulnerabilities, making encryption even more paramount to protect sensitive information on platforms that may not always be secure.

Future of Encryption Standards

As technology advances, so too must encryption standards. While 128-bit encryption remains steadfastly secure against current computational capabilities, the advent of quantum computing heralds a new era in cybersecurity. Quantum computers can potentially decipher traditional encryption methods at an unprecedented pace. Consequently, there is increasing interest in transitioning to stronger encryption standards, such as 256-bit encryption, which would further fortify data security.

Nevertheless, 128-bit encryption is not poised to be rendered obsolete imminently. The considerable resources required for brute-force attacks and the overall efficiency of this encryption level ensure its continued relevance in the foreseeable future.

Conclusion

In conclusion, 128-bit encryption represents a formidable standard in the realm of data security, particularly within the banking industry. It combines a robust key length with sophisticated algorithms to ensure that sensitive information is well-protected against unauthorized access. Banks embrace this encryption standard due to its impressive security profile, regulatory compliance, and the trust it engenders among consumers. As technology evolves, continuous advancements in encryption will be necessary to keep pace with emerging threats, but for now, 128-bit encryption stands as a pillar of security in the digital finance landscape.

Leave a Comment