In the modern era where digital interactions proliferate, the significance of secure communications cannot be overstated. Central to this realm is the concept of digital signatures, a form of cryptography that provides authenticity and integrity to electronic documents and communications. Understanding digital signatures is paramount, especially in legal contexts where the validation of electronic documents can determine the outcomes of litigation. This article delves into the mechanics, legal implications, and the overarching significance of digital signatures in today’s digital age.

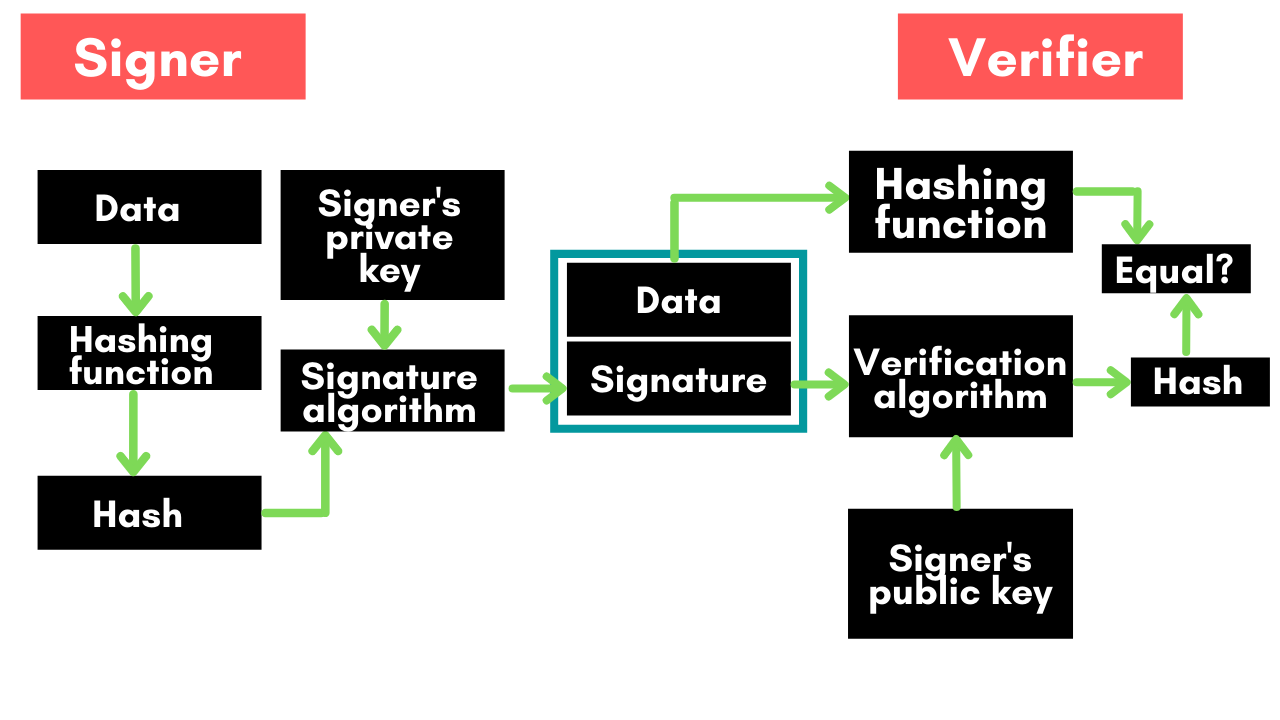

At its core, a digital signature leverages cryptographic techniques to validate the authenticity and integrity of a message or document. It resembles a handwritten signature but serves a heightened purpose by ensuring that the sender’s identity is verified and that the content has not been altered in transit. The process typically utilizes asymmetric cryptography, where a pair of keys—a public key and a private key—function collaboratively. The sender employs their private key to create a unique signature for the document, while the recipient uses the sender’s public key to verify the signature.

The allure of digital signatures lies in their multifaceted application beyond mere identity verification. In a world where cyber threats lurk in every corner, digital signatures mitigate the risk of forgery. Generally, a digital signature assures the recipient that the document originated from a verified source and that it remains unscathed during transmission. This property of non-repudiation prohibits the sender from denying their authorship of the signed document, thus playing a crucial role in legal disputes.

Exploring the legal ramifications of digital signatures, we find a rigorous framework that governs their application. Many jurisdictions have established legal acts acknowledging the validity of electronic signatures, demonstrating their acceptance in the courtroom. The Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) in the United States provides a legal basis for electronic signatures and specifically endorses digital signatures as trustworthy equivalents to traditional handwritten signatures.

The practicality of digital signatures extends into various sectors, including finance, healthcare, and international trade, facilitating swift and secure transactions. In finance, for instance, contracts signed digitally expedite banking operations and investment transactions while maintaining compliance with regulatory standards. Similarly, in healthcare, digital signatures safeguard patient information by ensuring that only authorized personnel have access to sensitive data. This layering of cryptographic assurance fosters not just compliance but enhances trust in electronic communications across uncharted digital terrains.

However, the implementation of digital signatures does not come without challenges. One significant concern is the need for robust public key infrastructure (PKI) to manage the distribution and verification of keys. Without a reliable PKI framework, the entire system’s integrity is called into question. Organizations must invest in proper systems to prevent breaches where adversaries could potentially forge signatures or intercept private keys, undermining the very trust digital signatures aim to create.

Another dimension to consider involves the evolving landscape of technology and the consequent emergence of quantum computing. Experts speculate that quantum advancements may challenge current cryptographic protocols, potentially rendering conventional digital signatures obsolete. The cryptographic community is actively researching post-quantum algorithms to safeguard digital signatures against future threats, indicating that while digital signatures currently offer protection, continuous innovation is necessary.

Aside from the technical intricacies, the concept of digital signatures elicits a deeper fascination—an intersection where law, technology, and human behavior converge. The reliance on digital signatures highlights society’s transition to digital realms, necessitating a reevaluation of traditional notions of trust and authentication. In jurisdictions where digital signatures are widely accepted, the sheer volume of electronic transactions reflects a cultural shift towards embracing technology as a facilitator of commerce and communication, albeit with accompanying responsibilities.

Moreover, this shift raises significant ethical considerations. The juxtaposition of convenience against security poses dilemmatic challenges. As organizations prioritize efficiency and speed, the onus of maintaining stringent security measures rests heavily upon them. Cybersecurity breaches, identity theft, and unauthorized access have all exacerbated discussions surrounding the ethical use of technology in business practices, mandating an increased awareness and vigilance among both corporations and consumers.

In conclusion, understanding digital signatures extends beyond the mechanics of cryptography to encompass profound legal and societal implications. The ability to verify identity and maintain document integrity is not merely a convenience; it is a necessity in a digitally dominated world. As we progress into an unprecedented landscape characterized by rapid technological changes, the intricate relationship between digital signatures and security, trust, and legal accountability will continue to evolve. The courtroom-ready nature of digital signatures underscores their critical role in maintaining the legitimacy of electronic transactions, fostering a more secure operational environment for all stakeholders involved.

Leave a Comment