In an age where the digital transformation has reshaped the financial landscape, a new contender emerges on the gridiron of consumer finance: the crypto credit card. This innovative financial instrument graphically intertwines the power of cryptocurrencies with the convenience of traditional credit cards, promising a unique appeal that beckons the modern consumer. In this exploration, we will navigate the terrain of buying a crypto credit card by uncovering its pros and pitfalls, effectively arming you with knowledge akin to a map before a treacherous expedition.

Pro: Seamless Integration of Crypto and Traditional Spending

The allure of a crypto credit card lies in its ability to transcend the boundaries between conventional currency and digital assets. Imagine this card as a bridge, elegantly spanning the divide between your crypto wallet and the myriad of everyday purchases. When utilized, it enables users to spend their cryptocurrency in the same manner they would with fiat currency. This seamless integration is akin to an alchemist turning lead into gold; it transforms digital coins into tangible transactional power, all while retaining the thrill of engaging with your crypto portfolio.

Pro: Rewards and Incentives

Ever sought an elixir that increases in potency with each sip? Many crypto credit cards come fortified with enticing rewards programs, often providing cash back or cryptocurrency rewards for purchases made. These rewards can vary significantly, but they generally include percentages of spent amounts converted back into cryptocurrency. For ardent fans of blockchain technology, this reward structure enhances the excitement of daily expenditures, with the potential to grow your crypto holdings simply by consuming goods and services.

Pro: Enhanced Security Features

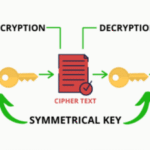

Security is paramount in the realm of financial transactions, and crypto credit cards do not skimp on this essential attribute. Many cards incorporate advanced security protocols such as dual verification processes and transaction alerts, rendering them far less susceptible to fraud. Picture these security measures as a knight’s armor—preventing harmful incursions while you confidently traverse the marketplace. Moreover, using these cards reduces the necessity of exposing sensitive bank information, as transactions often rely on crypto verification instead.

Pro: Encouraging Cryptocurrency Adoption

At their core, crypto credit cards serve as a catalyst for mainstream adoption of cryptocurrencies, fostering democratization of digital assets. Every swipe is an act that normalizes the idea of using cryptocurrencies in everyday transactions. Like the ripples created in a pond when a stone is thrown, each consumer participating in this ecosystem can inspire broader acceptance and understanding, nudging society further into the digital currency revolution.

Con: Volatility of Cryptocurrency

However, not all that glitters is gold. With the potential joys of using a crypto credit card comes the significant pitfall of volatility. Cryptocurrencies are notorious for their erratic price fluctuations, which can lead to unpredictable financial outcomes. For instance, purchasing a cup of coffee with Bitcoin may seem innocuous on a calm Tuesday, only for its value to plummet precipitously by the following weekend. This uncertainty could transform casual spending into a precarious gamble, making one question whether the risk is indeed worth the reward.

Con: Fees and Charges

Often lurking beneath the surface like a hidden undertow, fees associated with crypto credit cards deserve careful consideration. While some promotional offers may suggest a fee-free experience, the reality can be quite different. Monthly charges, foreign transaction fees, and withdrawal costs may bleed your wallet dry before you realize it. These charges are akin to a creeping mist—a seemingly benign presence that can obscure the broader costs associated with ownership, making it imperative to scrutinize the fine print before committing.

Con: Limited Acceptance

Another lurking shadow is the question of acceptance. While some retailers and service providers enthusiastically embrace cryptocurrencies, many remain unacquainted with these digital assets. This disparity can limit the usefulness of your crypto credit card. Imagine carrying a map that only leads to uncharted territories; the potential for misguided adventures is significant. Therefore, assessing the card’s acceptance within your desired spending network is essential before embarking on this journey.

Con: Complicated Tax Implications

The labyrinthine world of taxation pertaining to cryptocurrency can render the usage of crypto credit cards a complex endeavor. Every transaction utilizing your crypto funds could qualify as a taxable event, thereby potentially complicating your annual tax filings. This facet can be as perplexing as a riddle wrapped in an enigma, demanding a diligent accountant’s touch to navigate successfully.

Conclusion: A Double-Edged Sword

In conclusion, the decision to buy a crypto credit card presents itself as a double-edged sword, poised to offer both lucrative benefits and daunting challenges. While the integration of cryptocurrency with everyday spending fosters a new era of financial freedom, one must remain vigilant of the accompanying risks and costs. The choice ultimately depends on individual appetite for risk, current financial literacy, and willingness to embrace the evolving nature of digital currencies. As you stand at the crossroads, consider the journey carefully; this path may lead to treasure or trial, depending on how you wield this newfound instrument.

Leave a Comment