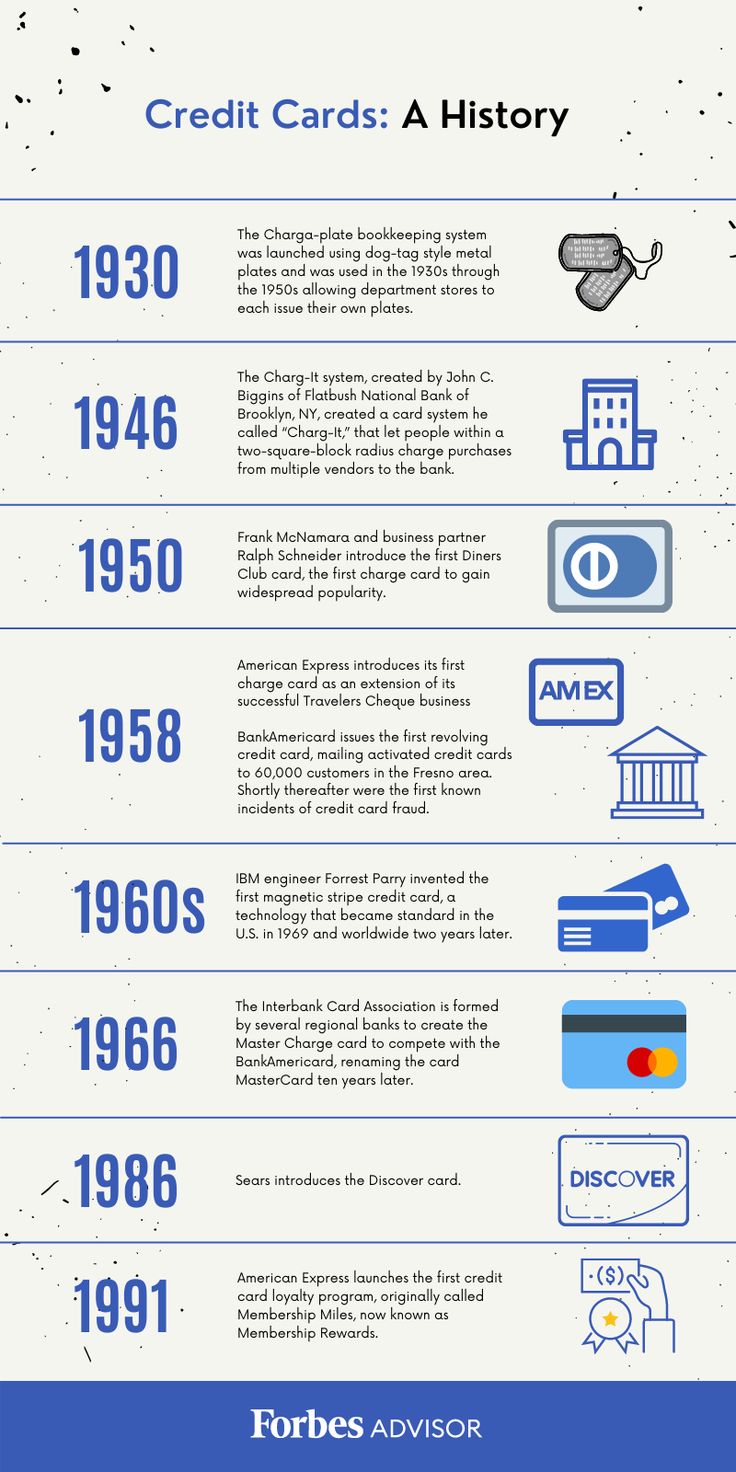

Credit cards have become ubiquitous in modern commerce, but their journey to popularity involved a myriad of verification methods that evolved significantly over the decades. From manual processes to electronic systems, the verification of credit cards has been a fascinating saga of technological innovation and consumer trust. This article explores the historical landscape of credit card verification, illuminating the various methodologies employed in the past and their evolution into the contemporary standards we recognize today.

Early Beginnings: The Charge Plate

The origins of credit cards trace back to the early 20th century, when merchants issued charge plates—small metal tokens that denoted a customer’s creditworthiness. Customers could use these plates at affiliated establishments, often inscribed with their name and a unique identifier. The merchant would charge purchases to a customer’s account, which would later be billed. The verification was rudimentary; it relied heavily on personal trust and local reputation. Merchants would often recognize returning customers by sight, leading to a system that was both intimate and fundamentally limited.

The Rise of Paper-Based Verification

As commerce expanded in the mid-1900s, the inadequacy of charge plates became apparent. Enter the credit card as we know it today. In 1950, the Diners Club introduced an innovative payment mechanism that allowed members to use a Card for dining and entertainment. Verification at this time involved a paper trail. When a diner settled a bill with a credit card, the merchant would fill out a sales draft, capturing pertinent transaction details. The server would then take the card to the back of the restaurant to call the company and verify the account. This system, while revolutionary, was slow and prone to human error.

Manual Verification Processes

During the 1960s and 1970s, credit card usage increased dramatically. The need for more reliable verification methods became pressing. Manual verification processes began to evolve, incorporating telephone verification systems. Merchants were instructed to call a central operator when a card was presented, providing the account number and customer details. This allowed for a more immediate verification but lagged when busy periods arose, needlessly extending transaction times.

Another interesting method involved the use of carbon paper. Merchants would create a multi-part draft, carbon-copying the customer’s information and transaction details for record-keeping. The merchant would then send a portion of this draft to the issuing bank to obtain payment, further embedding the verification process within the banking systems of the day.

Introducing Magnetic Stripes

The technological landscape began to shift in the 1970s with the introduction of magnetic stripe technology. This innovation represented a watershed moment in the verification of credit cards. The magnetic strip, embedded with coded information, allowed for swift and efficient verification. When the card was swiped through a reader, the encoded data would transmit to the bank for immediate authorization.

This leap not only expedited transactions but also reduced the manual errors typical of previous systems. The reader would check the validity of the card against the bank’s database, which stored relevant account information. However, this system relied on a robust network of phone lines and processing capabilities, which, while groundbreaking, required considerable infrastructure investment.

Transition to Electronic Verification

By the 1980s and 1990s, credit card fraud grew considerably, prompting further advancements in verification technologies. The introduction of Electronic Data Capture (EDC) devices allowed merchants to capture transaction data electronically. EDC machines could connect to bank databases via telephone lines, providing instantaneous verification and dramatically reducing fraud risk. This was achieved through enhanced security protocols, including the use of Authorization Codes, which confirmed the legitimacy of the transaction instantaneously.

At the same time, the advent of point-of-sale (POS) systems revolutionized how verification was handled. Merchants began integrating comprehensive software solutions that linked directly to their inventory management systems while incorporating credit card payment processing into a singular interface. This innovation facilitated not just verification but also streamlined the entire transaction process, enabling quicker service.

Continued Evolution: Chip Technology

The dawning of the 21st century further transformed credit card verification. The emergence of EMV chip technology in the late 2000s added a new layer of security. Each transaction is encrypted, generating a unique code for every use, rendering stolen card data almost useless. This technology markedly reduces the risk of counterfeit fraud, which had surged in prior years as card-not-present transactions became more prevalent through online shopping.

Conclusion

From humble beginnings with charge plates to the sophisticated security measures employed today, the verification of credit cards has seen a remarkable transformation. Each step forward has been characterized by a concerted effort to balance the convenience of credit transactions with security measures to protect consumers and merchants alike. As technology continues to advance, it remains to be seen how verification processes will evolve, but one thing is certain: the journey of verification in the realm of credit cards is far from complete.

Leave a Comment