The world is on the precipice of a transformative epoch, as cryptography and cryptocurrency converge, promising a departure from conventional financial paradigms. The juxtaposition of these two fields prompts an inquiry: how will cryptographic principles shape the future of digital currencies? Numerous institutions and individuals are beginning to fathom the ramifications of this fusion, suggesting a reshaping of the financial landscape that is as exhilarating as it is perplexing.

At the core of cryptocurrency lies cryptography, a formidable means of ensuring data integrity and security. This advanced technology employs intricate algorithms to encode and decode information, safeguarding transactions and ensuring that participants remain anonymous if desired. How did we arrive at this intersection? Understanding the roots of cryptography reveals its evolution from a necessity in military communications to an imperative in financial transactions.

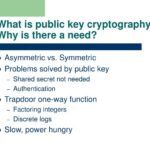

Historically, cryptography was wielded to protect state secrets during wartime. Techniques such as substitution ciphers evolved into complex systems like the Enigma machine. Fast forward to the 21st century, the advent of the internet catalyzed a paradigm shift. Information became digital, and thus, the necessity for protection grew exponentially. Innovations such as public-key cryptography and hashing algorithms emerged, laying the groundwork for what would soon become the backbone of cryptocurrencies.

The genesis of Bitcoin in 2009 marked a seismic shift in this narrative. Utilizing blockchain technology—an immutable ledger secured through cryptographic principles—Bitcoin introduced decentralization to the monetary system. Unlike conventional currencies, Bitcoin enables peer-to-peer transactions without the intermediation of financial institutions. This radical feature invites curiosity about the implications for global finance and the potential for diminishing the hegemony of banks.

Yet, this evolution is not devoid of challenges. The burgeoning market for cryptocurrencies has also bred a plethora of security vulnerabilities. High-profile hacks and frauds have illuminated the urgent need for more sophisticated cryptographic measures. The cataclysmic loss of assets has instigated a clarion call for robust encryption technologies that can withstand the onslaught of cyber threats. One intriguing countermeasure is the exploration of quantum-resistant cryptography, designed to protect against the inevitable evolution of computing power that could render current algorithms obsolete.

Digital currency proponents often extoll the virtues of cryptocurrencies: reduced transaction costs, borderless transfers, and enhanced accessibility for the unbanked. However, the continuum of benefits must also accommodate an awareness of the darker undercurrents. As cryptocurrency emerges as an alternative financial medium, its role in illicit activities has attracted scrutiny. Transactions are often lauded for their anonymity, yet this very feature can facilitate nefarious undertakings such as money laundering and the financing of terrorism. The juxtaposition of cryptography’s protective aims with these ethical dilemmas engenders a complex dialogue about the future role of regulation in this domain.

In response, governments and regulatory bodies are grappling with the dual imperative of fostering innovation while safeguarding public interest. Could this herald a new era of collaboration between innovators in cryptocurrency and regulators, rather than an adversarial dynamic? The integration of compliance protocols within the architecture of cryptocurrencies is becoming increasingly plausible. This endeavor requires a rethinking of trust—perhaps transitioning from a reliance on centralized entities to an autonomous system grounded in cryptographic guarantees.

Furthermore, the advent of decentralized finance (DeFi) presents yet another intriguing facet of cryptocurrency. By utilizing smart contracts—self-executing contracts with the agreement directly written into lines of code—DeFi platforms are challenging traditional banking services. This innovation paves the way for greater financial inclusion, whereby users can lend, borrow, and trade without the constraints imposed by conventional financial intermediaries. Nonetheless, the reliance on cryptographic validation raises questions about vulnerabilities within smart contracts themselves, demanding continued scrutiny and innovation.

Amid this tumultuous landscape, one cannot help but ponder the societal implications of a cryptocurrency-driven economy. At its essence, this shift signifies a redistribution of power from centralized entities to individuals. The democratization of finance fosters a burgeoning sense of agency among users, who can exert greater control over their assets. Yet, coupled with this empowerment falls the weight of personal responsibility. The promise of autonomy inadvertently challenges individuals to become more financially literate, navigating a digital frontier that is as expansive as it is complex.

As we stand on the cusp of unprecedented developments, the convergence of cryptography and cryptocurrency cultivates a fertile ground for speculation. Questions abound: Will cryptocurrencies become a universally accepted medium of exchange? Can regulatory frameworks evolve to enhance trust while allowing for innovation? How will advancements in cryptographic technology continue to shape these dynamic systems? The answers to these inquiries will not only delineate the future of financial transactions but may also redefine our very conception of value itself.

In conclusion, the intersection of cryptography and cryptocurrency embodies a confluence of technology and finance that invites profound reflection. As these domains continue to intertwine, the implications for society are staggering. This convergence promises to challenge, inspire, and provoke curiosity about the future that lies ahead. Thus, as we chart this uncharted territory, one can only marvel at the possibilities that await in this brave new digital age.

Leave a Comment