In the labyrinthine world of finance, where cryptography and technology converge, a novel instrument has emerged to illuminate the path of digital currency usage: crypto cards. These hybrid financial tools allow users to navigate the volatile landscape of cryptocurrencies while retaining the familiarity of traditional spending methods. But what exactly are these crypto cards, and how do they work? This exploration will unravel the intricacies embedded within this cutting-edge financial innovation.

At their core, crypto cards resemble the conventional debit or credit cards that have dominated consumer finance for decades. However, they differ significantly in function and utility, most notably in their ability to facilitate transactions in cryptocurrencies. Imagine standing at the intersection of a physical marketplace and a digital frontier—the allure of crypto cards lies in their capacity to shuttle users seamlessly between these realms. They act as gateways, enabling users to wield the formidable power of digital assets with the ease of a swipe.

To understand how crypto cards operate, it is imperative to delve into the technology underpinning them. Typically, these cards are linked to a digital wallet, which serves as a reservoir for various cryptocurrencies. Users can fund their wallets by purchasing digital currency from exchanges or receiving it through transactions. The transactions can encompass a spectrum of cryptocurrencies, ranging from prominent players like Bitcoin and Ethereum to lesser-known altcoins.

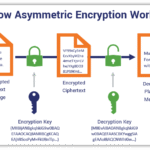

The mechanism by which crypto cards execute transactions is as fascinating as it is intricate. When a user makes a purchase using a crypto card, the card provider converts the cryptocurrency into fiat currency, applicable to the merchant’s requirements. This conversion occurs in real-time, ensuring that users can spend their digital assets without the burden of immediate market fluctuations. The sophistication of this process resembles the alchemy of ancient times, turning one form of currency into another without the alchemist ever needing to step out of their laboratory.

An essential feature of crypto cards is the associated transaction fees. While some may favor the idea of using cryptocurrencies for everyday expenditures, they must also consider the costs that accompany these transactions. Depending on the provider, fees can vary significantly, often representing a percentage of the transaction amount. Thus, users must navigate this cost-benefit analysis, weighing the convenience and benefits of crypto spending against potential surcharges.

Moreover, security is paramount in the realm of cryptocurrency. Crypto cards employ various safeguards, such as two-factor authentication and biometric access, to protect users’ assets against potential breaches. This emphasis on security is akin to fortifying a castle—ensuring that only those possessing the rightful credentials can breach the gates. Consequently, users can forge ahead in their financial endeavors with a modicum of confidence that their digital treasures are safe.

Another intriguing aspect of crypto cards is their potential to earn rewards in the form of cryptocurrency. Similar to traditional reward programs, several crypto card providers offer benefits to users who engage in spending. These rewards may materialize as cashback or additional cryptocurrency deposited into users’ wallets, presenting yet another layer of appeal for individuals who wish to leverage their expenditures. The notion of earning while you spend creates an enticing dichotomy, drawing individuals deeper into the fold of cryptocurrency adoption.

The infusion of crypto cards into mainstream finance has profound implications for consumer behavior. These cards have taken abstract concepts of decentralized finance and embedded them into everyday transactions, making them tangible. It fosters a growing acceptance among the average consumer, who may have previously regarded cryptocurrencies as speculative investments or niche technology. With the swipe of a card, a kaleidoscope of possibilities unfolds, inviting users to partake in the digital economy.

Furthermore, the allure of crypto cards extends beyond mere convenience; they offer a glimpse into a broader economic transformation. As more consumers adopt these financial instruments, the demand for cryptocurrencies may escalate, propelling further innovation in the fintech sector. Crypto cards can be viewed as catalysts—a spark igniting a fire of curiosity among users about the decentralization of currency, blockchain technology, and the future of financial transactions.

Nevertheless, navigating the crypto card landscape is not without its complexities. Users should remain cognizant of regulatory developments in their jurisdiction. Governments worldwide grapple with how to categorize and regulate cryptocurrencies. Consequently, the evolving legal landscape could impact the functionality of crypto cards, influencing aspects such as taxation and transaction legitimacy. The dynamic relationship between regulation and innovation presents an ongoing balancing act, one that users must understand as they venture into this new financial territory.

As the digital economy continues to burgeon, crypto cards occupy a pivotal role—one that transcends traditional financial instruments. These cards symbolize a marriage of convenience and innovation, offering a passport to the expanse of cryptocurrency spending. Yet, like any tool in finance, educated understanding is paramount. User diligence concerning fees, rewards, security, and regulations remains essential as the world of crypto cards unfolds.

In conclusion, crypto cards represent an intriguing evolution in the world of currency and spending. Positioning themselves as the bridge between traditional finance and the innovative realm of cryptocurrencies, they embody a transformative symbiosis. By wielding these cards, users can embrace the digital future, equipped with both the power of decentralization and the comfort of tradition—a substantial feat in the quest for a more fluid financial ecosystem.

Leave a Comment