In an evolving digital landscape, the advent of cryptocurrency ATMs has sparked intrigue among technophiles and finance enthusiasts alike. These machines promise an intriguing juxtaposition: a link between the digital realm of cryptocurrencies and the tangible world of cash. However, the question that emerges is this: can you truly withdraw crypto from ATMs? To answer this, we must delve into the mechanics, capabilities, and practical use of cryptocurrency ATMs.

Since their inception, Bitcoin ATMs have garnered attention for their convenience, enabling users to buy and sell cryptocurrencies in a physical location. Typically, these ATMs support various popular cryptocurrencies, most notably Bitcoin. Users can deposit cash into the machine, which subsequently converts fiat currency into cryptocurrency. Yet, this function alone does not encompass the entire scope of Bitcoin ATMs. The technology behind these machines has evolved, and many now facilitate the withdrawal of cash exchanged for cryptocurrencies.

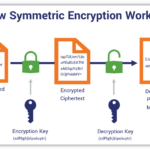

Understanding the operational backbone of cryptocurrency ATMs is imperative. These machines function similarly to traditional ATMs, albeit with distinctions pertinent to the blockchain technology that undergirds cryptocurrency transactions. A user seeking to withdraw cash must first select the option to exchange cryptocurrency for fiat currency. This transaction requires the user to either have an existing cryptocurrency wallet containing the requisite amount or to acquire more through the ATM itself.

Furthermore, some Bitcoin ATMs allow users to withdraw readily available funds in the form of cash by selling their cryptocurrencies. This point merits further examination. The availability of cash withdrawals hinges on a few critical factors: the user’s wallet balance, transaction fees, and the machine’s liquidity. Operators of these ATMs often hold a limited supply of cash, which may affect a user’s ability to complete a transaction. Thus, potential users should be cognizant of the operational constraints when planning withdrawals.

The allure of utilizing cryptocurrency ATMs extends beyond mere transactions; it intersects with the broader narratives surrounding cryptocurrency adoption. As adoption rates soar, so too does the proliferation of Bitcoin ATMs across urban landscapes, turning these machines into indispensable conduits for engaging with digital assets. This shift indicates a broader acceptance of cryptocurrencies within mainstream commerce and finance, affording a blend of traditional and novel transactional methodologies.

Despite their potential, the regulatory frameworks governing cryptocurrency ATMs are often nebulous. Varying regulations across regions can complicate the user experience. For instance, some jurisdictions mandate stringent identification requirements, impacting the anonymity traditionally associated with cryptocurrencies. Therefore, users must prepare for possible hurdles, such as identity verification processes, which could impede immediate access to cash withdrawals.

Moreover, understanding the fees associated with transactions at these ATMs is vital for a seamless experience. Typically, fees can range from 5% to 20% depending on the machine and location. This range can considerably affect the net value users receive from their withdrawals. Consequently, users should engage with multiple ATMs to ascertain which provides the most favorable rates and lowest fees, ultimately optimizing their transactions.

Nevertheless, the mechanics of withdrawing cash from cryptocurrency ATMs introduce questions regarding user security and fraud. The decentralized nature of cryptocurrencies, while providing anonymity, also invites risks related to hacking, theft, or scams. Users are encouraged to exercise prudent caution, ensuring that they engage with reputable machines, ideally located in secure environments. Moreover, understanding common scams associated with cryptocurrency transactions can mitigate potential risks.

As users navigate the complexities associated with withdrawing crypto from ATMs, they also encounter an intriguing dichotomy between the speed of transactions and the inherent delays of technology. Once a user initiates a transaction, processing can take anywhere from minutes to hours, depending on network congestion and the blockchain confirmation process. This acknowledgment is crucial for individuals who may expect instantaneous transactions akin to traditional banking methods.

In exploring the practical realities of withdrawing cash from cryptocurrency ATMs, one must reflect on the broader implications for the future of finance. As traditional banking institutions wrestle with adapting to a digital-centric world, cryptocurrency ATMs stand as a testament to the innovative solutions emerging in this space. They symbolize a growing acceptance of cryptocurrency within the fabric of economic transactions and present an opportunity for individuals seeking financial autonomy.

In conclusion, the answer to the question of whether one can withdraw crypto from ATMs is multifaceted and layered with complexities. The ability to withdraw cash from cryptocurrency ATMs is real, though it is mitigated by operational constraints, regulatory frameworks, and user awareness of fees and security measures. As the technological landscape continues to evolve, the dialogue surrounding cryptocurrency ATMs remains pivotal in understanding the future of digital finance. The nuances inherent in these machines compel potential users to consider not only their utility but also the implications for their engagement with the ever-expanding world of cryptocurrencies.

Leave a Comment