In an era characterized by rapid technological advancement, the advent of contactless debit cards has transformed the way consumers engage in transactions. This innovation offers unparalleled convenience—merely tapping a card to pay eliminates the need for physical currency or entering a PIN. However, beneath this veneer of efficiency lies an intricate web of security concerns that warrant rigorous exploration. Are contactless debit cards truly secure, or do they harbor vulnerabilities that could expose users to significant risks?

The primary allure of contactless debit cards lies in their expediency. Transactions can be completed in a matter of seconds, allowing for brisk purchases in retail settings and seamless interactions at transportation hubs. This ease of use is particularly advantageous in an increasingly fast-paced society. Despite these benefits, the very mechanisms that facilitate contactless payments—Radio Frequency Identification (RFID) and Near Field Communication (NFC) technology—are not without their drawbacks.

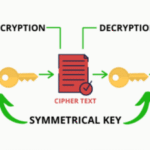

Central to the debate around the security of contactless debit cards is the concern of electromagnetic interference. These cards transmit data wirelessly when near a compatible payment terminal, which ostensibly simplifies the process of payment. However, it also renders them susceptible to interception. Cybercriminals can deploy RFID readers to illicitly scan for card information, potentially capturing sensitive data such as the card number and expiration date without the cardholder’s awareness.

This phenomenon raises significant ethical issues regarding consumer protection. Financial institutions often assure users of the robustness of encryption and security protocols surrounding the transactions. However, such assurances can create a false sense of security. If fraud occurs, the repercussions can be disastrous for consumers, resulting in monetary loss and a cumbersome recovery process involving multiple stakeholders.

Moreover, the convenience afforded by contactless payment systems can inadvertently encourage consumer negligence. Users may be less vigilant about monitoring their statements and transactions, given the psychological comfort that comes with swift and unencumbered purchasing. This laxity can further exacerbate the issue if unauthorized transactions occur. In a digital landscape increasingly populated by threats, one’s vigilance can be the finest line of defense.

Another compelling facet of this dialogue concerns the limitations of liability imposed by financial institutions. While many issuers provide a degree of fraud protection to users of contactless debit cards, the specifics often remain ambiguous. Reporting fraudulent transactions within a stipulated timeframe might yield reimbursement; yet, the onus of vigilance often falls squarely on the cardholder. Such nuances in policy can leave consumers vulnerable and unaware of their true level of protection.

The question, then, arises: how can consumers safeguard themselves against potential threats posed by contactless technology? Several best practices could serve to bolster security while enabling users to retain the convenience of contactless payments. For instance, cardholders should consider implementing additional layers of security, such as transaction alerts or enabling two-factor authentication where possible. Awareness of one’s financial landscape becomes paramount; regular scrutiny of transactions can catalyze early detection of any irregularities.

Furthermore, the introduction of anti-RFID wallets presents a proactive measure against electronic pickpocketing. These wallets are designed to block unauthorized scans, mitigating the risk of data theft. Consumer education surrounding the risks associated with contactless credit and debit cards is equally vital. Knowledgeable consumers are better equipped to navigate the potential pitfalls of this technology.

An analysis of the broader implications of contactless payment systems leads to an inexorable conclusion: while the convenience is undeniable, the susceptibility to fraud necessitates a profound reconsideration of current practices. Financial institutions and payment services must prioritize transparent communication regarding security risks, ensuring that users are aptly informed. Additionally, as technology evolves, continuous innovation in security measures is imperative. Solutions such as tokenization—whereby sensitive card information is replaced with a unique token that has no intrinsic value—pave the path toward a more secure environment for digital transactions.

International standards for contactless payment security also warrant examination. Standards set by bodies such as the EMVCo, which governs the technical specifications for payment transactions, should be adhered to with utmost diligence. Adhering to robust security standards not only fortifies individual transactions but also bolsters consumer confidence in the evolving landscape of digital finance.

As the trajectory of financial transactions continues to evolve, the multifaceted nature of security concerning contactless debit cards remains an ever-pertinent discussion. While their advantages are manifold, the potential vulnerabilities cannot be overlooked. Integrating technological advancement with a rigorous security framework is imperative; this dual focus can propel the industry toward a future where convenience and security coexist harmoniously.

In conclusion, the narrative surrounding contactless debit cards is one that embodies both the zest of innovation and the caution exercised by prudent consumers. Ultimately, it is the responsibility of stakeholders—consumers, financial institutions, and service providers alike—to engage in a collective endeavor that prioritizes safety in a rapidly digitizing world. The balance between harnessing convenience and ensuring security will define the next chapter in the evolution of payment systems.

Leave a Comment