In an era where digital banking has become ubiquitous, the security of mobile applications has gained paramount importance. The seamless convenience of accessing financial services through apps often belies the sophisticated technologies employed to safeguard sensitive user data. A profound comprehension of how banks encrypt mobile applications can unveil a riveting tapestry of cybersecurity strategies, bolstered by an intricate understanding of encryption methodologies.

At the crux of mobile banking security is the encryption process, which transforms plaintext, or readable information, into ciphertext, rendering it incomprehensible to unauthorized entities. This cryptographic technique acts as a formidable barrier against potential cyber threats that loom over the fintech landscape. The encryption ensures that even if a breach occurs, the data remains indecipherable without the correct decryption key.

Understanding the protocols involved in mobile app encryption begins with the relevant cipher algorithms. Banks typically employ Advanced Encryption Standard (AES) as it stands as a gold standard in encryption technology. This symmetric-key algorithm operates on block ciphers with key lengths of 128, 192, or 256 bits, making it exceptionally robust against brute force attacks. The decision to utilize AES allows financial institutions to fortify user data while concurrently expediting transaction times—a meticulous balancing act of security and efficiency.

However, the encryption process transcends merely employing a sophisticated algorithm. Secure Sockets Layer (SSL) and its successor, Transport Layer Security (TLS), are pivotal in establishing secure communications between mobile applications and their servers. These protocols create an encrypted tunnel through which data traverses, precluding eavesdropping and man-in-the-middle attacks that could jeopardize sensitive information. The incorporation of SSL/TLS ensures that the encryption process extends beyond local data storage, enveloping data in transit with formidable protective measures.

Another salient aspect of mobile encryption lies in tokenization. Instead of storing sensitive information such as credit card details or bank account numbers, banks transform this data into unique identifiers or tokens. This process mitigates the risks associated with data breaches, as the actual sensitive information is securely stored in a centralized environment rather than the mobile device itself. By utilizing tokens, financial institutions can also foster compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS), denoting an industry-wide commitment to safeguarding consumer data.

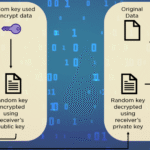

Moreover, the quintessential role of Public Key Infrastructure (PKI) deserves investigation. PKI facilitates the generation and management of encryption keys through a framework of cryptographic protocols. In a typical banking scenario, a user’s device generates a public-private key pair. The public key, shared with the bank server, is employed for encrypting information that can only be decrypted by the private key, known solely to the user’s device. This asymmetric encryption approach vastly enhances security, as even if an attacker intercepts the public key, they cannot decrypt the data without access to the private key.

In examining these encryption techniques, one must not overlook the significance of regular updates and patches. Cybersecurity is not static; as threat vectors evolve, so too must the defenses that protect against them. Banks implement continuous monitoring for vulnerabilities, adopting a proactive stance to fortify their applications. This invariably includes updating encryption protocols and addressing any potential weak links in their defenses, signifying an unwavering commitment to safeguarding user data amidst a continually shifting threat landscape.

The fascination surrounding banking app encryption can also be attributed to the ongoing cat-and-mouse game with cybercriminals. Each time new security measures are adopted, malicious actors devise more sophisticated methods to circumvent them. This dynamic interplay not only emphasizes the necessity for constant innovation in encryption methods but also fuels interest in the realm of cybersecurity as a whole. Understanding the lengths to which banks go to protect their customers invites intrigue and underscores the gravity of cyber threats faced daily.

Moreover, biometric authentication has begun to intertwine with encryption methodologies, offering an additional layer of security. Fingerprint scanning, facial recognition, and voice recognition serve as unique identifiers that augment traditional password systems. These biometric markers can be linked to encrypted tokens, thereby creating a multifactor authentication process that significantly elevates the security posture of mobile banking applications. The amalgamation of biometric verification and robust encryption serves as a striking example of how banks innovate to counteract potential threats.

Ultimately, the encryption of banking mobile apps acts as a testament to the intricate network of technologies underpinning modern financial services. Understanding the multifaceted layers of encryption, from algorithms to tokenization and biometric security, reveals a hidden world where data protection is paramount. The reliance on cutting-edge cryptographic practices not only safeguards user data but also reinforces trust in the banking system itself. With the evolution of cyber threats and the relentless pursuit of innovation in security measures, the future of mobile banking encryption remains as compelling as ever, underscoring its critical role in ensuring secure transactions in our digital-first society.

Leave a Comment