In the vast terrain of internet security, where the sanctity of sensitive data hinges upon the efficacy of encryption protocols, the distinction between Secure Sockets Layer (SSL) and Secure Electronic Transaction (SET) protocols emerges as a pivotal point of understanding. Navigating the intricate web of online transactions leads to a deeper comprehension of these two crucial protocols. While they may both function under the overarching banner of securing data, their philosophies and applications diverge significantly.

SSL was conceived by Netscape in the mid-1990s as a means to establish a secure channel between a client and a server, predominantly focused on protecting data integrity and confidentiality during transmission. The framework operates on a triumvirate of confidentiality, authentication, and integrity—ensuring that the information shared across the internet remains impervious to prying eyes and malicious entities. SSL employs both asymmetric and symmetric encryption techniques to fortify this protection: the former is employed for the initial handshake where encryption keys are exchanged, while the latter is utilized for the actual data transmission, allowing for rapid and efficient communication.

On the other hand, SET came into existence during the height of e-commerce aspirations in the late 1990s. Developed under the auspices of Visa and MasterCard, SET was tailored specifically to facilitate secure credit card transactions online. The protocol introduced a plethora of security measures pertinent to payment processing, including the necessity of involving not just the cardholder and the merchant but also the issuing banks. This layered approach ensured that the authenticity of financial transactions was verifiable at multiple points, thereby echoing a more multifaceted dimension of online security.

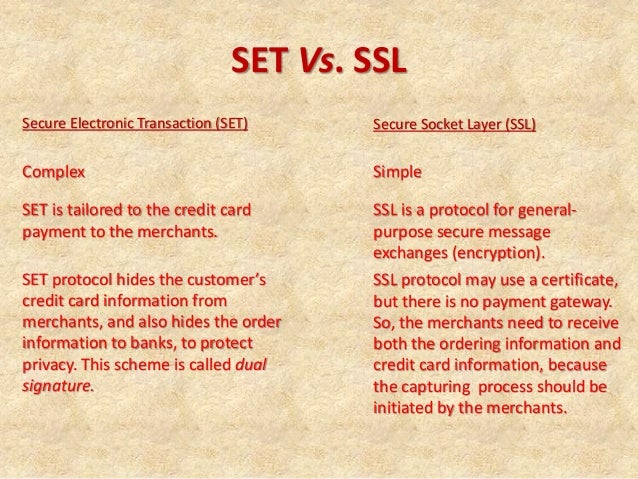

One of the defining characteristics distinguishing SET from SSL is the management of payment information. SSL’s primary function is to protect data in transit; it does not inherently focus on the specificity of payment authentication. Conversely, SET was engineered with a dedicated purpose of verifying payment details while ensuring the privacy of cardholder information. This facet is paramount for consumers in a digital marketplace, as it diminishes the apprehension associated with online purchases.

Moreover, while SSL typically provides a straightforward encryption process for any data transferred across a web server, its structure simplifies transaction security but may lack the exhaustive capabilities needed for sensitive payment information. SET’s intricate architecture ensures that card numbers are not visible during transactions. Instead, merchants receive a tokenized version of the payment method, alleviating the risk of unauthorized access or fraud.

Another aspect of inquiry pertains to the transaction method. SSL serves as a general-purpose protocol applicable across various types of data exchanges, enabling secure web browsings, such as accessing banking websites or conducting ecommerce transactions. SET, in stark contrast, is expressly designed for credit card transactions, necessitating stringent adherence to security standards, which ultimately engenders an environment of trust for both merchants and consumers.

The implementation of SSL is relatively seamless for web developers, conforming to the established framework of web technologies. It can be integrated effortlessly into existing infrastructures, requiring minimal alterations to the operational processes. SET, however, demands a more rigorous deployment schedule involving a suite of specialized tools and partnerships with financial institutions. This complexity can pose hurdles for smaller online enterprises keen on leveraging its robust security features.

Despite these differences, both protocols face evolving challenges in a landscape demarcated by rapid technological advancements. SSL has endeavored to evolve, transitioning from its original form to TLS (Transport Layer Security), an enhanced successor that delivers greater security assurances and resilience against emerging threats. Yet, even SSL/TLS has not been entirely immune to criticism, as questions arise regarding potential vulnerabilities that could be exploited by nefarious actors.

Similarly, SET has largely fallen into obsolescence as the ecommerce ecosystem has matured. The advent of alternative payment solutions, such as digital wallets and tokenization technologies, has relegated SET to a background position. This shift reflects an industry-wide pivot towards more user-friendly and flexible security measures that prioritize consumer experience while ensuring the same, if not greater, levels of protection.

Looking ahead, both SET and SSL/TLS encapsulate fundamental learnings in the domain of internet security. Their stark differences not only highlight the evolution of online transaction protocols but also illustrate the pressing urgency of adapting to an incessantly changing technological landscape. The landscape of secure communications is fraught with potential pitfalls, yet an understanding of these protocols fosters an awareness of the mechanisms that shield personal and financial data.

In conclusion, discerning the difference between SSL and SET is pivotal for anyone navigating the online ecosystem, primarily due to the critical importance of security in our increasingly digital lives. This understanding holds the key to grasping the nuances of online transactions—a fundamental requisite for any stakeholder in the realm of e-commerce. As technology continues to progress, so too will the methods we utilize to protect ourselves in virtual realms, prompting an ever-evolving dialogue on security ethics, consumer trust, and the ongoing quest for enhanced safeguards in the digital age.

Leave a Comment