In the contemporary digital sphere, the question of whether it is safe to share your 16-digit card number looms large. The proliferation of online transactions has ushered in a myriad of concerns regarding security and privacy. To navigate this intricate landscape, one must delve into the mechanics of credit card security, understand potential vulnerabilities, and examine preventive measures to safeguard sensitive information.

The first point to consider is the structure of the 16-digit card number itself. Typically, this sequence comprises four sets of four digits, delineating critical information relevant to the cardholder. The first six digits represent the Issuer Identification Number (IIN), which identifies the issuing bank. The subsequent digits are unique to the cardholder, while the final digit serves as a checksum, calculated through a mathematical algorithm known as the Luhn formula. While this structure is inherently designed to facilitate transactions, it also poses a risk if disclosed improperly.

One of the paramount risks associated with sharing your card number is fraud. Credit card fraud manifests when criminals acquire your card details, often through phishing schemes or data breaches. Cybercriminals employ sophisticated methods, such as malware and keylogging, to capture card information during transactions. The anonymity provided by the internet further exacerbates this risk, as perpetrators can exploit stolen data with relative impunity.

Moreover, the risk is not limited solely to unauthorized transactions. Identity theft can transpire when predators procure not only your card number but also personally identifiable information (PII), initiating a cascade of unauthorized activities that can irrevocably damage one’s financial standing. This underlines the gravity of exercising discretion when disclosing card details.

While certain platforms may solicit your 16-digit card number, vigilance is essential. Secure websites typically use encryption protocols, such as Secure Socket Layer (SSL) or Transport Layer Security (TLS), to protect data in transit. An indicator of this security is the presence of “https” in the URL, as opposed to merely “http.” However, do note that mere observation of these indicators does not guarantee complete security, necessitating a thorough examination of the platform’s credibility.

Cybersecurity hygiene is paramount. One should refrain from sharing card information over unsecured connections or public Wi-Fi networks. Such environments are fertile grounds for interception. Instead, utilize private networks or utilize a Virtual Private Network (VPN) to obscure your internet traffic, enhancing your security posture.

Additionally, consider the utility of virtual or disposable cards. Many banks and financial institutions offer such features, allowing users to generate a temporary card number that links to their primary account. This innovative approach mitigates the risk of exposure since, even if compromised, the temporary number can be easily rendered useless.

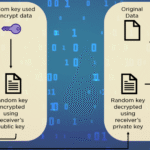

Another facet worth exploring is the role of tokenization and encryption in mitigating risks surrounding card number sharing. Tokenization replaces sensitive card details with unique identifiers or “tokens” that can be used for transactions without revealing the actual card information. Meanwhile, encryption transforms data into an unreadable format unless decrypted with the correct key. Both methods represent significant advancements in protecting consumers, exemplifying a proactive approach to cybersecurity.

Despite the precautions one may take, breaches can and do occur, reinforcing the importance of monitoring one’s accounts regularly. Consumers should be vigilant in scrutinizing their bank statements for any unauthorized transactions. Financial institutions often provide automated alerts for suspicious activities, which can serve as an early warning system for potential fraud.

The question of what constitutes “safe” sharing of your 16-digit card number extends beyond personal judgment; it intertwines with the broader narrative of digital security. It is also critical to stay informed about the evolving landscape of cybersecurity threats. Knowledge empowers individuals to make informed decisions regarding their financial information. Engaging with resources that chronicle recent data breaches, phishing trends, and fraudulent schemes can provide valuable insights into maintaining security.

In conclusion, sharing your 16-digit card number necessitates a cautious and well-informed approach. Understanding the potential implications, employing security best practices, being proactive about protecting your information, and remaining vigilant are instrumental in not only securing your finances but also bolstering overall confidence in engaging in digital transactions. The digital marketplace will continue to flourish, but one must never lose sight of the importance of safety and security in this interconnected age.

Leave a Comment