The digital age has endowed us with myriad conveniences, yet it also harbors a plethora of vulnerabilities. Among these is a proclivity among many to transmit sensitive data—specifically, credit card information—through email. A veritable double-edged sword, email facilitates communication; however, it simultaneously presents a gaping chasm of security risks that often go unrecognized.

In the grand tapestry of cybersecurity, the act of emailing credit card information serves as a telling metaphor for recklessness. Much like sending a postcard through the postal service, an email lacks the confidentiality necessary to safeguard sensitive material. Consider the sender, penning their confidential secrets on an open medium, unaware that anyone with minimal intent can glimpse what should remain private.

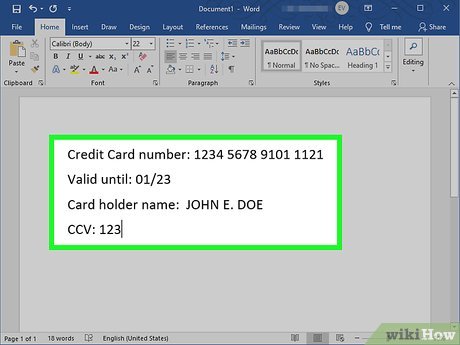

It is essential to start with an understanding of how email operates. Upon clicking send, the email traverses various servers before reaching its destination. Each stop along the way poses a potential risk, akin to a traveler passing through a series of unguarded checkpoints. Malicious actors, equipped with an arsenal of tools, can intercept this transmission, snatching confidential details from the ether with alarming ease.

Encryption serves as a protective layer, yet it is a mere patch on a fundamentally flawed system. Email encryption methods, such as Pretty Good Privacy (PGP) or Secure/Multipurpose Internet Mail Extensions (S/MIME), provide a semblance of security, but these are not universally adopted. For the average user, the labyrinthine process of encryption can feel daunting. Moreover, if the recipient lacks the means to decrypt the information, the effort becomes moot. Thus, while encryption offers a fortified shield, it is vital to recognize that not all shields are equally impenetrable.

Phishing attacks further complicate the issue. These malicious schemes target unsuspecting individuals, masquerading as legitimate entities to extract confidential information. A simple email, luring the unwary with promises of urgency and necessity, can lead to irrevocable financial consequences. The sophistication of modern phishing attempts rivals the craft of experienced con artists, and even those with training can find it challenging to identify the ruse. Trusting an email to convey credit card information is akin to inviting a stranger into one’s home, offering them not only one’s possessions but also the keys to the front door.

Data breaches present another layer of complexity. The digital repositories containing our personal data are not impervious. Corporations, businesses, and even government entities have fallen prey to cybercriminals, resulting in leaks of sensitive information. When your credit card information is stored in an unencrypted database or transmitted via unsecured channels, it becomes a tempting target. Imagine leaving a trophy on the doorstep of a notorious thief; the allure of access is simply too compelling to resist.

Moreover, the human factor complicates this landscape. Despite the rigorous technological safeguards in place, human error remains an Achilles’ heel. An unintended click on a malicious link, an accidental attachment sent to the wrong recipient, and a momentary lapse in cautiousness can all precipitate the downfall of information security. This vulnerability underscores the reality that security is not merely a technical challenge but a behavioral one. Trusting email with sensitive financial data is akin to giving a near-sighted driver the keys to a high-speed vehicle; the risk is disproportionately high compared to the convenience offered.

To illustrate the perils more vividly, envision a bustling marketplace. The vendors—with their colorful wares displayed, enticing passersby—symbolize the vast network of online services that require credit card information. Shoppers, eager to procure goods, engage in transactions at each stall. Yet, beneath this vibrant façade, unseen pickpockets stealthily observe and wait for an opportune moment. Every transaction made via email is akin to flashing one’s wallet in that marketplace, beckoning theft.

As an alternative, consider more secure methods of transferring credit card information. Secured websites, indicated by “https” in the URL, provide a safer avenue for online transactions. Payment gateways and encrypted apps add layers of protection that email simply cannot match. Furthermore, utilizing digital wallets can abstract your credit card data, reducing the risk posed by direct transmissions.

Additionally, employing two-factor authentication and regularly monitoring one’s financial statements creates a bulwark against potential fraudulent activities. These strategies illustrate the importance of adopting a holistic approach to personal cybersecurity, recognizing that the responsibility does not solely rest on technological infrastructures but also on individual vigilance.

Ultimately, the confluence of ease and danger serves as a poignant reminder: the omnipresence of digital communication does not necessitate haste when sharing sensitive details. The act of emailing credit card information may seem innocuous, yet it is fraught with hazards that one must not overlook. By choosing prudence over convenience, individuals can safeguard their financial well-being against the unseen threats lurking in the digital shadows. The digital marketplace may glitter with promise, but wary shoppers remain the most successful in navigating its complexities.

Leave a Comment