The advent of cryptocurrency has engendered a radical transformation in the landscape of finance, prompting numerous inquiries among users and investors. One pertinent question that arises in this digital age is whether it is feasible to transfer cryptocurrency directly to a credit card. As the world becomes increasingly intertwined with digital currencies, understanding the mechanisms involved in these transactions is imperative for those navigating this complex universe.

To begin with, it is crucial to delineate what cryptocurrency is. Cryptocurrencies are decentralized digital assets utilizing blockchain technology, enabling peer-to-peer transactions without the need for intermediaries such as banks. While their allure is predicated on the notion of autonomy and innovation, transferring these assets to conventional financial instruments—such as credit cards—poses a myriad of challenges and considerations.

The fundamental aspect to consider is that credit cards, by their very nature, are structured to facilitate transactions in fiat currencies, such as the U.S. dollar, euro, or yen. This raises significant questions about how a cryptocurrency could be effectively converted into a format that is compatible with a credit card. Henceforth, one must explore the various modalities through which cryptocurrency enthusiasts might crystallize this transfer.

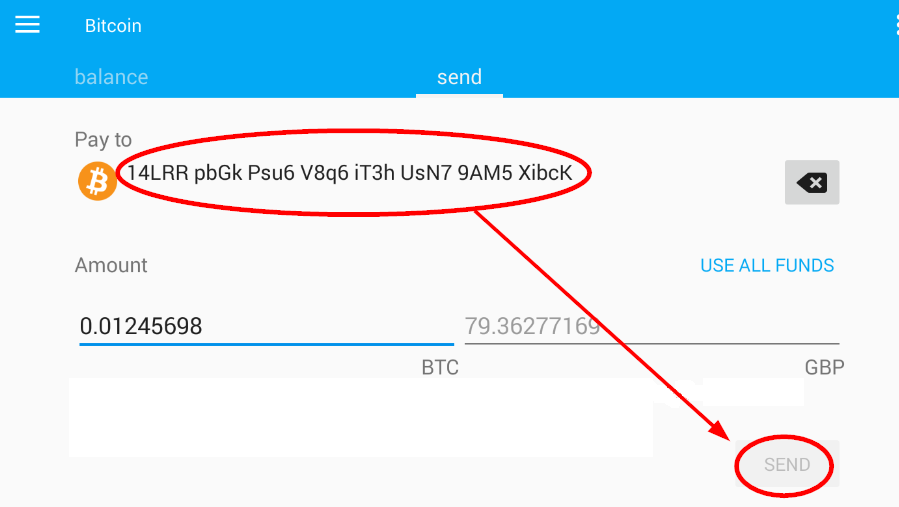

One prevalent method for converting cryptocurrency to fiat currency involves the utilization of cryptocurrency exchanges. These platforms, such as Coinbase, Binance, and Kraken, allow users to sell their digital assets in exchange for traditional currencies. After completing this conversion, users can then withdraw the fiat currency to their credit cards or bank accounts. This method features a series of steps, typically including verification, selling the cryptocurrency, and initiating a transfer of the resulting fiat currency.

However, while this method appears straightforward, it is replete with intricacies. One must consider the variability in exchange rates, potential fees incurred during the transaction, and the duration of processing times. These factors can influence the overall experience and satisfaction of the user. Furthermore, it is essential to recognize that these transactions may be subject to regulatory scrutiny in various jurisdictions, underscoring the need for vigilance among users.

Moreover, the anticipation of transfer speeds introduces an additional layer of complexity. Cryptocurrency transactions can lag behind traditional banking processes, resulting in delays that could lead to significant fluctuations in value. This variability raises the question: is it advisable to convert cryptocurrency to fiat solely for the purpose of transferring to a credit card? The answer necessitates a comprehensive understanding of the market dynamics at play.

In light of these challenges, some may wonder whether cryptocurrency debit cards could present a solution. These cards, issued by various companies, allow users to load cryptocurrency onto a prepaid debit card, which in turn can be utilized for transactions at any merchant accepting traditional payment methods. For instance, cards like those provided by Crypto.com leverage this unique operational model, bridging the chasm between digital assets and everyday purchasing power. Such cards typically offer a seamless user experience, with the added convenience of having a single card that facilitates the use of multiple cryptocurrencies.

However, ponder this: while the allure of cryptocurrency debit cards is undeniable, they are not without their drawbacks. Users must be wary of associated fees, potential limitations on withdrawing cash, and the inherent volatility of cryptocurrency values. Additionally, the need to maintain a meticulous understanding of the card’s terms of service becomes paramount, as conditions can vary dramatically between different issuers.

Another intriguing avenue worth investigating is the rise of platforms that enable direct transactions in cryptocurrency. Some merchants and service providers now accommodate payments in cryptocurrencies like Bitcoin and Ethereum, thereby circumventing the need for conversion altogether. This paradigm shift signifies a burgeoning acceptance of digital currencies in mainstream commerce. If this trend continues, it could potentially alter the need for traditional conversion methods and redefine the usage of credit cards in the cryptocurrency ecosystem.

Yet, a pivotal question lingers in the minds of many: what recourse do users have when faced with problems during cryptocurrency transactions? The answer is multifaceted, as it largely depends on the avenue chosen for the transaction. Engaging with reputable exchanges often offers some level of customer support, but resolutions may not always come swiftly. For those utilizing cryptocurrency debit cards, customer service can vary significantly among issuers.

It is also prudent to remain cognizant of the legal ramifications inherent in transferring cryptocurrency to credit cards. Governments worldwide are grappling with regulatory frameworks that govern digital assets, occasionally resulting in abrupt changes that could impact the usability of cryptocurrencies. Staying up-to-date with these developments is not just advantageous; it is essential for safeguarding one’s financial interests.

Ultimately, the question of transferring cryptocurrency to a credit card is layered, intricate, and rife with considerations. The pathways available are varied, from exchanges to debit cards, each marked by advantages and challenges. As the landscape of cryptocurrency continues to evolve, so too will the modalities with which users engage with their assets. Therefore, remaining informed, vigilant, and adaptable is paramount for those seeking to navigate this rapidly changing financial frontier. As one contemplates this shift in perspective, the underlying premise remains clear: the journey of cryptocurrency is as captivating as it is complex, urging us to question and redefine our traditional interactions with currency.

Leave a Comment